Values

BENEFITS OF HIRING A VACATION PROPERTY MANAGEMENT COMPANY

RELIEVE YOUR STRESS

We will take the day-to-day burdens that come with overseeing a vacation property off your shoulders so you can focus on other aspects of life. You will no longer have to worry about completing paperwork, collecting money, dealing with sudden emergencies, etc.

REDUCE VACANCY CYCLES

We will always be working hard to bring in new renters to keep your property booked throughout the year. We understand how to effectively market your vacation rental so that it stands out among the competition and attracts Alabama’s coastline visitors.

MAINTAIN PROPERTY

We set a high standard for the properties we represent for both the sake of our guests and owners. This means you can rest assured that we have a strong commitment to keeping rentals in top condition. It will remain clean and maintained to avoid costly repairs.

Estimate Your Vacation Rental Income Potential

Calculate Your Rental IncomeVACATION PROPERTY MANAGEMENT

You are living the dream! You own your own perfect spot in the sand along the beautiful Alabama Gulf Coast. But that dream is turning into a nightmare, with high management fees, less than expected annual rental revenue, and an endless array of nickel and dime charges. Owning your own vacation home is becoming more trouble than it’s worth. However, before you throw in the towel on the potential to make a good profit on your investment, you should know that there is a solution out there: Gulf Shores and Fort Morgan, AL property management!

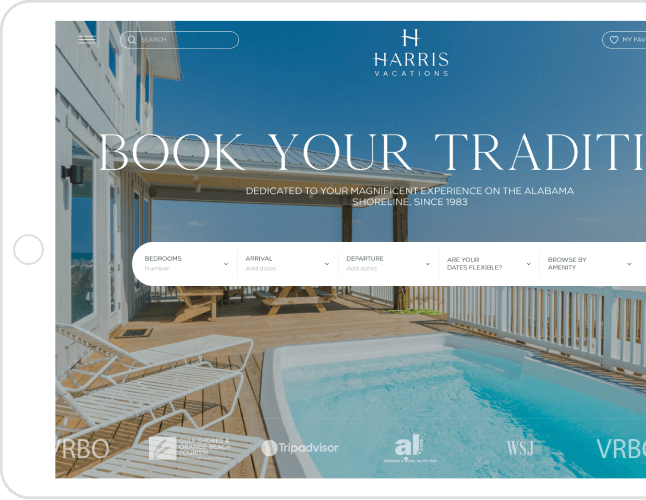

Harris Vacations is the answer! We have built our company from the ground up to be owner focused and owner driven. We are owners ourselves and have been for over 30 years! We know what property owners want and will work tirelessly to provide you with the best owner experience on the Alabama Gulf Coast. Let us make your vacation home live up to the dream you always believed it could be with our Gulf Shores, Fort Morgan, Perdido Key, and Orange Beach property management services!

CONTACT US

CONTACT US

KATY HOLT

Business Acquisition & Property Manager

Contact our investment specialists to learn more about maximizing your rental income or to start the vacation home-buying process with our real estate experts. We will be glad to discuss any of your concerns regarding Gulf Shores, Orange Beach and Fort Morgan Property Management.

CALL MANAGER:

251-424-7175[email protected]